Want to Buy or Sell Your Home Off Market?

If you want to learn more about how to sell a house off market get in touch with our team and we can help you out.

Fill out the form and we’ll be in touch soon!

As the year begins to come to an end, it is important to evaluate the current Arizona housing forecast for 2024. The year 2024 is expected to bring more stability to the housing market after a few years of uncertainty. With mortgage rates declining faster than expected, home prices are likely to remain mostly flat throughout 2024. This will be good news for buyers who have been waiting on the sidelines for a good time to enter the market.

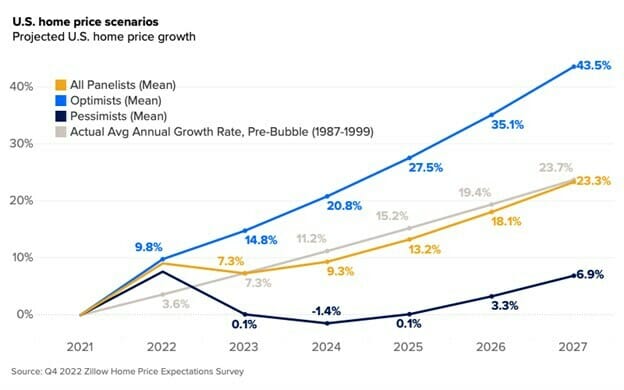

Economists and housing experts polled in the latest Zillow Home Price Expectation (ZHPE) survey expect home prices to fall 1.6% through Dec. 2023. Challenges with affordability are still continuing to bring down the demand for homes currently. Starting in 2024, it is expected for price growth to pick back up, at an average clip of 3.5% per year through 2027.

Sales of existing homes are forecast to fall to 4.2 million in 2023 – up slightly from November and December’s seasonally adjusted annual rate of sales, but lower than 5.0 million sales in the course of calendar year 2022. Mortgage rates are expected to trend downward after the first quarter. It is predicted that rates for 30-year fixed loans will be highest between now and 2025.

Falling rates are far more helpful for affordability than falling home prices, at least at the scale of recent movements. The median respondent projected a 6% rate for 30-year fixed-rate mortgages at the end of 2023. The rapid rise in home prices that we saw in recent years is likely to slow down in the next few years. However, home prices are still expected to rise, albeit at a more moderate pace.

According to a report by Zillow, home values are projected to increase by 5.5% over the next year, slower than the 16.9% increase seen in 2021. Zillow predicts that home values will increase by 3.5% in 2023, 3.4% in 2024, 3.3% in 2025, and 3.2% in 2026. The report also notes that the number of homes for sale will continue to be low, putting upward pressure on prices.

Rising interest rates are expected to make it more expensive for buyers to borrow money to purchase homes. Mortgage rates have been at record lows for several years, but many economists predict that they will begin to rise in the coming years including 2024. Higher interest rates will decrease buying power of potential buyers and lead to a decrease in demand, which will put downward pressure on prices.

If you want to learn more about how to sell a house off market get in touch with our team and we can help you out.

Fill out the form and we’ll be in touch soon!